Check out our 2025 brief with updated information on this issue!

With increasing inflation, current teachers are concerned that their salaries won’t keep pace with the cost of living, and district leaders are concerned that increased costs in their regions will dampen their efforts to attract new teachers. A recent EdWeek Research Center survey indicated that “(s)alary increases that exceed increases in the cost of living” would entice 60% of teachers to stay in the teaching profession long term. This is more critical in some localities because the cost of housing often prices teachers out of a particular labor market; salaries and cost of housing also affect the diversity of the workforce, as teachers of color and early career teachers are affected disproportionately.

Education leaders have shown creativity in how they seek to address this housing affordability problem to support current teachers and recruit new ones, with solutions ranging from tiny homes in rural Arizona to motels in Texas and convents in Silicon Valley. But the housing problem has two facets: availability of affordable housing and a teacher’s ability to afford housing. Regarding the latter, home rentals and average house prices have increased by more than 20% and 40%, respectively, in the last five years,1 and the increases in teacher salaries have not kept pace.

This month’s District Trendline dives into the affordability of the housing market and its link to teacher staffing challenges, by looking at the cost of housing in 69 metropolitan areas and comparing those costs to teacher salaries in the largest school districts within those metropolitan areas.2 We looked at three questions:

- Can novice teachers afford rent near their schools?

- How long will it take teachers to buy a home?

- Can teachers afford the ongoing costs of homeownership?

We find a wide range of housing affordability for teachers among these metropolitan areas. In 15 cities, renting a one-bedroom home is unaffordable for a beginning teacher. In 54 other cities, a one-bedroom rental is affordable. Similarly, while in eight localities a teacher could save up for the average home down payment in less than 10 years, in six of these metropolitan areas, it would take a teacher more than 20 years to save up for the average home down payment.

Can new teachers afford rent near their schools?

High rents can price teachers out of some local markets, which in turn can have detrimental effects on school districts’ staffing.

Can new teachers afford the average rent for a one-bedroom in the largest U.S. metro areas?

| (FY2022; one income household) |

| Note: In this map, rental costs below and up to 30% of a teacher’s gross income are colored in shades of blue to indicate that they are affordable, according to HUD’s definition of housing affordability, and those above 30% are colored in shades of red to indicate that they are unaffordable. |

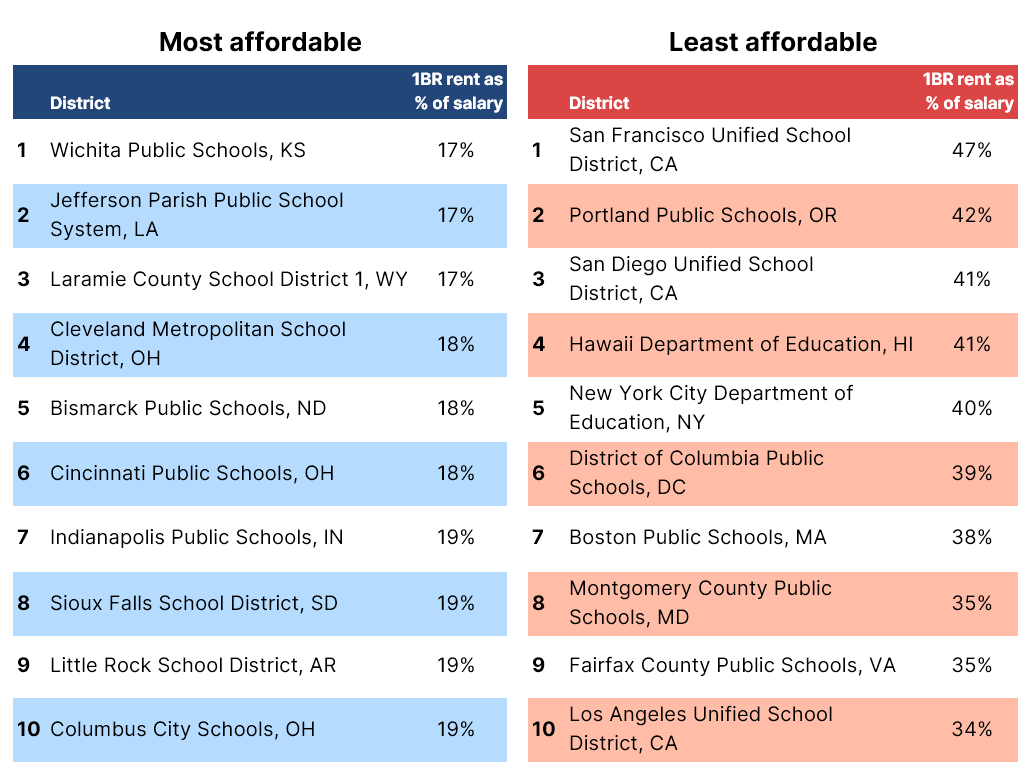

Young professionals often rent for a few years before they can buy a home. In 15 out of the 69 metropolitan areas analyzed, paying for a one-bedroom rental3 would be unaffordable4 for beginning teachers with a bachelor’s degree5 (indicated by red dots on the figure above), as the cost of renting a one-bedroom home would be more than 30% of a beginning teacher’s salary. Consequently, teachers may choose to live far from their schools, facing multiple-hour commutes, which has been shown to be predictive of higher turnover.

Additionally, in nine of the 15 metropolitan areas (representing 11 districts), the cost of rent is more than 30% of a teacher’s salary, even for beginning teachers with a master’s degree, where the additional salary they receive ($5,000/year on average) is not enough to make renting a home near their work affordable.

Since we last looked at housing affordability for teachers in 2017, the rent for a one-bedroom home in the largest metropolitan areas in the U.S. has increased by 22%. In contrast, starting teacher salaries (for beginning teachers with a bachelor’s degree) have increased by 15%.

This varies a lot by locality. Twenty-one of the districts analyzed (corresponding to 20 metro areas) increased their beginning teacher salaries more than the increase in the cost of a one-bedroom rental.

Albuquerque Public Schools (NM) stands out for increasing its teachers’ starting salaries by 47%, while the cost of renting a one-bedroom home increased by 15%. On the other hand, in 53 of the districts analyzed, rising rental costs outpaced increases to teacher salaries. At the most extreme, a one-bedroom rental in Sacramento (CA) has increased by 50% since 2017, and Sacramento City Unified School District’s beginning teacher salaries have increased by only 9% in the same time period.

In three of the districts that have given their teachers cost-of-living increases that exceed the increase in rent over the last five years—Fairfax County Public Schools (VA), Montgomery County Public Schools (MD) (both in the DC metropolitan area), and San Francisco Unified School District (CA)—rent still constitutes a financial burden for their teachers, representing more than 30% of a teacher’s salary.

Recently, some localities have approved significant salary increases for teachers. Little Rock, for example, through the recent LEARNS Act, plans to bump starting salaries from $45,500 to $50,000. That would reduce a beginning teacher’s rent burden from 19% to 17.5%. Similarly, the salary raises included in the new Los Angeles Unified School District agreement that amount to a 21% salary increase between 2022 and 2025 would help decrease beginning teachers’ rent burden from 34.3% to 33.6% by 2025 (and perhaps by even more, if rent prices don’t grow by as much as they have over the last six years).

How long will it take teachers to buy a home?

Even after years in the workforce, teachers may face financial difficulties entering the housing market. For many teachers, it is an ordeal to save up for a down payment to buy a home in the area where they work.

It takes a little over four years for the average household6 in the U.S. to save for a 20% down payment for a home. In the largest metropolitan areas in the U.S., with a single teacher income, it would take 13.6 years for this teacher to save up 10% of their income each year to make a 20% down payment on a median house in their locality.7 If the teacher holds a master’s degree (which typically results in a higher salary), it would take 12.5 years. This is about three years longer than the average time to save for a down payment that we estimated in 2017.

Again, there is a lot of variation by locality. In Kanawha County Schools (WV), an individual teacher (with a bachelor’s degree) could save for a down payment for an average home in less than 10 years. In contrast, teachers with a bachelor’s degree who teach in urban Honolulu and in Los Angeles, San Diego, and San Francisco Unified school districts in California would have to save for over 20 years for a 20% down payment for a home of median value, which in those cities stands above $800,000.

How long does it take a teacher to save for a 20% down payment for an average home in the largest U.S. metro areas?

| (FY2022; at an annual savings rate of 10% of gross salary) |

Districts where it takes the least and the most time to save for a 20% down payment of a median home

Over the last five years, housing prices have increased at a rate that has outpaced average teacher salary increases for all the districts in this analysis but one: Denver Public Schools. Housing prices between 2017 and 2022 have increased an average of 47% in the 69 metropolitan areas in this analysis—ranging from 21% in Fairfax County to 77% in Tampa—while average salaries for teachers with bachelor’s degrees8 have increased by approximately 15%.

In Denver, housing prices between 2017 and 2022 increased by 39.7%, while average teacher salaries in Denver Public Schools increased by 40.5%.

Can teachers afford the ongoing costs of homeownership?

U.S. homeowners are well aware that the financial burden does not end at the down payment. Being a homeowner can be expensive, and some places are more expensive than others. So now we turn to analyze if the burden of homeownership is manageable on a teacher’s salary.

In 49 out of the 74 districts analyzed here, the cost of homeownership, meaning the combined monthly payment,9 exceeds 30% of a teacher’s gross income—assuming the teacher has a bachelor’s degree and 15 years of experience. In 41 of these 49 districts, the average cost of home ownership still exceeds 30% of the teacher’s income after 20 years of experience. Notably, in Los Angeles Unified School District (CA), even after 20 years, the cost of homeownership would exceed 50% of a teacher’s salary, although the newly negotiated salary increase will help.

On the other hand, homeownership is much more affordable for teachers in Cincinnati Public Schools (OH), Cleveland Metropolitan School District (OH), Indianapolis Public Schools (IN), and Pittsburgh Public Schools (PA), where the cost of homeownership lies below 25%, even for a household run by one teacher with a bachelor’s degree and only 10 years of experience. In Pittsburgh, these costs represent less than 20% of the salary of a single teacher with 10 years of experience.

Can teachers afford home ownership costs in the largest U.S. metro areas?

| (FY2022; one income household) |

| Note: In this map, homeownership costs below and up to 30% of a teacher’s gross income are colored in shades of blue (to represent that they are affordable under HUD’s definition), and those above 30% are colored in shades of red to represent that they are unaffordable. |

Conclusion

The cost of housing in many metropolitan areas in the United States has exacerbated the staffing challenges that school districts in those urban areas face, and in particular the districts’ ability to attract teachers of color, given their disproportionate student loan debt burden. A recent report of the National Education Association indicates that housing incentives, such as reduced rent, down payment assistance, or reduced mortgage rates, would play an important role in attracting and retaining teachers.10 A survey by the same organization indicated that about a quarter of all educators have unpaid student loan debt, and Black educators are disproportionately affected by student debt burden (40% of them have unpaid student debt and higher amounts of it), which decreases their means to afford housing. Before the pandemic, 22% of teachers with unpaid student loan debt reported struggling to make rent or mortgage payments; lately that has risen to 28% according to the same survey.11 These reports from teachers who bear multiple financial burdens are further evidence that teachers are struggling to afford housing at their current salaries.

As the nation turns its attention to raising teacher pay, states and districts may want to consider how to increase salaries or provide other incentives, so teachers can keep pace with increases in cost of living, in particular with a focus on the coastal metropolitan areas where housing affordability issues have persisted over the years. Additionally, policymakers need to be aware that housing policies impact the composition of the teacher workforce. Low-interest loans and down payment or housing subsidies could be effective tools to improve attracting teachers to localities where housing costs are less affordable. School districts also need to pay attention to both starting salaries and salary growth. If starting salaries are too low to feasibly afford rent, districts could face an aging workforce with difficulty attracting new teachers. Salaries that grow too slowly would have the opposite effect, potentially generating higher turnover of more experienced teachers. States and districts may also decide to target salary increases, especially given limited resources, to attract and retain teachers in the schools, regions, and subjects with the greatest shortages where the investments might yield the greatest impact.

More like this

How are districts observing and providing feedback to teachers?

How are school districts using strategic pay to attract and retain teachers where they need them?

What teachers really want: It isn’t just higher salaries

Are teacher salaries keeping up with inflation?

Endnotes

- We compare data from 2017-18 to 2022-23 for salaries and housing prices.

- This analysis includes

the 50 largest metropolitan areas in the United States, plus the largest

metropolitan areas in states not included within those 50. In total, we

analyzed 69 metropolitan areas, which comprise 74 school districts since some

metropolitan areas span across several districts. Metropolitan areas used here

are those defined by the U.S. Census Bureau as “Metropolitan Statistical

Areas,” which “consist of the county or counties (or equivalent entities)

associated with at least one core (urbanized area or urban cluster) of at least

10,000 population, plus adjacent counties having a high degree of social and

economic integration with the core as measured through commuting ties.” - The cost of a one-bedroom rental was obtained from the U.S. Department of Housing and Urban Development (HUD) and its Fair Market Rent dataset https://www.huduser.gov/portal/datasets/fmr.html. It defines fair market rent as the “40th percentile gross rents for standard quality units within a metropolitan area.” Note that a similar analysis conducted by NCTQ in 2017 used rental and housing cost data from Zillow. The current analysis uses housing cost data from the U.S. Department of Housing and Urban Development (HUD), which provides costs specific to one-bedroom rentals; the estimates from these different sources are very close.

- The U.S. Department of Housing and Urban Development (HUD) defines housing affordability as “paying no more than 30% of gross income for housing costs, including utilities.” Therefore, we consider rent to constitute a cost burden if it adds up to more than 30% of a beginning teacher’s salary.

- To determine rental affordability, we compared the cost of a one-bedroom rental to the first-year salary of a teacher with no prior experience.

- It is worth noting that, according to U.S. Census data, the average household has 1.3 incomes. The

current comparison in the analysis accounts for one teacher income, but even in

households with two teacher incomes (this scenario can be found in this

section’s map), the time to save for a down payment is still significantly

longer than for the average U.S. household. - The price for the median home was calculated using Zillow’s Home Value Index, using the values of homes in the 35th to the 65th percentiles in the metropolitan area indicated, with data for fiscal year 2022 currently spanning from July 2022 to February 2023. https://www.zillow.com/research/data/. Teachers’ savings were obtained by assuming teachers advance along the salary schedule of their corresponding lane (bachelor’s or master’s), and therefore their salaries grow over the years. Thus, we calculated savings by adding up 10% of these growing salaries in five-year intervals (to facilitate graphic display) until those savings meet or exceed 20% of the median home value.

- Average teacher salary increases were calculated by comparing the average salary specified on the bachelor’s lane of the salary schedule for each district, between the school years 2017-18 and 2022-23.

- American Community Survey (ACS) defines cost of homeownership as the combined monthly payment for “mortgage principal and interest, real estate taxes, homeowner’s insurance, utilities, mobile home costs, second mortgage payments and condominium fees if applicable.” The data for these calculations was taken from the 2021 five-year ACS for the counties corresponding to the 69 metropolitan areas analyzed.

- National Education Association (NEA). (October 2022). Elevating the Education Professions: Solving Educator Shortages by Making Public Education an Attractive and Competitive Career Path.

- Hershcopf, M., Puckett Blais, M., Taylor, E.D., and Pelika, S. (2021). Student Loan Debt Among Educators: A National Crisis. Washington, DC: National Education Association.