Last week we

were stunned to learn that Chicago

had just laid off another 1,000 teachers, in addition to the 420 teachers it

laid off when the district closed 50 schools.

Even for a district as large as Chicago that is a serious, serious

cut: almost 7 percent of its teachers.

How

come? Pension obligations, plain and

simple, says the district.

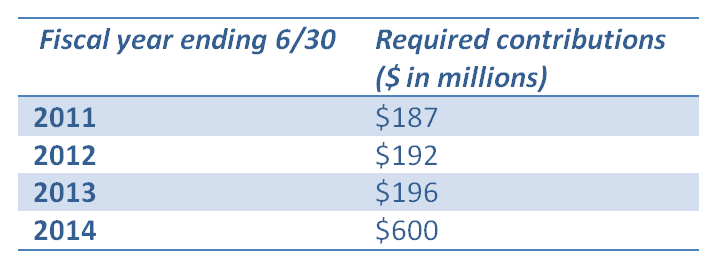

There are two

teacher pension systems in Illinois: there’s the one that is referred to as “downstate” (for every district BUT Chicago) and the one that is “upstate,”

(Chicago’s). Illinois has a law unique to the upstate pension plan which requires the Chicago Board of Ed

to make up any shortfalls in pension funds when they drop below 90 percent of

those needed to meet obligations. As the table below indicates, 2014 is when the

walls come crashing down, with the district having to triple its contributions:

Contributions by

Chicago BOE to the teacher pension fund required under Public Act 96-0889

The city had

two choices to raise the $600 million it needs to meet pension obligations:

raise taxes (which the state has already done) or cut public services,

including releasing public school employees.

What’s so appalling here is that what’s good for the Chicago

goose apparently isn’t good for the downstate gander. Downstate Illinois districts are more

than $43 billion in the hole (and counting) in the other pension plan, but that

plan has not subjected itself to an obligation similar to Chicago’s and is not

required by law to do so.